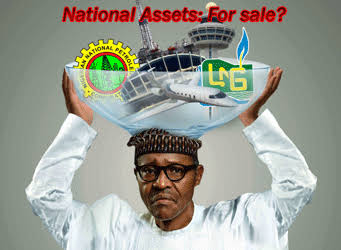

President Buhari has thought it through that selling the national assets is the only way out of recession. The Buhari-led administration seems to be looking for any way possible to turn the dying economy of this country around.

Due to the desperation to earn more on the assets, the government would reasonably not sell at a normal price or an affordable one for private business firms to buy them and the group of people who has the resources to buy these assets are the politicians and the already well-known business tycoons in the country. It is of no use if the government sells off assets without the masses deriving any positive impact from the economic measure of selling the country’s assets.

Further findings cannot but make one wonder why the recovered loot is still sitting in the treasury without it being used. Or maybe it is time for one to start asking whether any loot has been recovered at all? Because it is simply of no use to sell your property if you have the money to pay your debt.

Femi Falana, in an exclusive discussion, postulates that if the law allocation is reduced, the government would have enough money to come out of recession. Seeing how both the Senate and the House of Representative delegates are of nothing more than 500 members, how then can the allocation of 500 people cater for the need of close to 4 million people? Not totally a bad idea, but still not good enough.

Another that needs to be examined is the country’s liability. If Nigeria sells off its assets and then pays off her liabilities in terms of foreign and domestic debt, would the net revenue still be enough to bring this nation out of recession? Bearing in mind that Assets – Liabilities = Revenue and Nigeria only has bondholders and not shareholders who generate their yield from total income and not net income.

Matter arises in the issue of what the country would run with if the national assets are sold? Does that mean we would have to majorly depend on investors who would totally define our economy? Recently, the MPC (Monetary Policy Committee) came up with a brilliant idea to keep up their rate at 14% but the problem is that the MPC rate is directly proportional to growth which is the country’s GDP and inversely directly proportional to inflation rate. What this means is that if the single digit rate is to be maintained, inflation has no limit but growth will be enhanced, and if the MPC rate should increase above the percent given, inflation will be pushed down but growth will depreciate. The outcome of this solution indicates that the country’s economic situation is in a fix.

What then is the solution? Anambra State Government has initiated a good economic policy to help people residing in that part of the country only by reducing their tax revenue. This fiscal policy initiated has helped the people to couching the recession by making their take home more for spending instead of the usual the government takes from them. Nigeria can imbibe the same policy for everyone to be relieved. Awarding of contracts too would help couching the effect as major parastatal within the country can welcome the idea of employing people to work and delegating assignments for execution to smaller firms within the same jurisdiction.

Selling of the nation’s assets does not seem to be much of a brilliant idea. The government needs to go back to the drawing board and come back out stronger with an economic stimulating policy.

God bless Nigeria!